The cost of flood insurance is often a topic of concern for homeowners in flood-prone areas like Fort Lauderdale. With its coastal geography and increasing chance of severe weather events, understanding how much flood insurance costs in Fort Lauderdale is essential for property protection and peace of mind. In this comprehensive guide, we unravel the specifics to help you navigate the complexities of flood insurance.

Understanding Flood Insurance Costs in Fort Lauderdale

Breaking Down the Average Cost of Flood Insurance

In Fort Lauderdale, flood insurance costs can vary significantly based on numerous factors. On average, homeowners can anticipate paying anywhere from $500 to $1,500 annually for flood insurance. This range depends on aspects like

flood zones

, the

flood risk

associated with location, property elevation, and coverage limits.

One of the key influencing cost factors is the flood zone designation of your property. High-risk flood zones will generally incur higher premiums due to the increased possibility of flooding events. For example, homes situated in FEMA-designated high-risk zones, such as SFHA (Special Flood Hazard Areas) are likely to face higher costs compared to properties in lower-risk zones.

Factors Influencing Flood Insurance Rates

Various elements contribute to the

insurance rates

of flood insurance in Fort Lauderdale. The key factors include the specific flood zone, the elevation of the home, the type of coverage selected, and whether the insurance is purchased privately or through the National Flood Insurance Program (NFIP). Additionally, other determinants such as building materials and the age of the home can also affect premium rates.

For instance, homes with protective structures like levees or advanced water drainage systems may qualify for reduced premiums. Conversely, properties lacking elevation or located on floodplains usually pay higher insurance premiums. Evaluating your home on these parameters can help you better understand your rate calculations and explore cost-saving strategies.

Comparing Flood Insurance Options

Choosing between private flood insurance and policies provided by the NFIP is another crucial decision that influences insurance premiums. Private insurers might offer more customized coverage options than the NFIP, potentially resulting in better cost-efficiency for homeowners. However, the NFIP provides standardized policies and can be more accessible to those with homes in high-risk areas.

When comparing options, consider coverage limits, deductibles, and the insurer’s reputation for customer service and quick claims processing. These details can significantly impact the overall cost and value of your flood insurance policy.

Flood Insurance in Fort Lauderdale: A Cost Perspective

Flood Insurance Rate Factors in Florida

Across Florida, several factors specific to the state influence flood insurance rates. Coastal proximity, elevation levels, and climatic conditions are paramount in determining insurance costs. Homes closer to the coastline, such as those in Fort Lauderdale, face higher risks, which drives up the expenses compared to interior regions.

The policy premiums also depend on legislative reforms and changes in state policies regarding flood management. Keeping abreast of such changes can aid homeowners in seeking beneficial adjustments to their flood insurance policies.

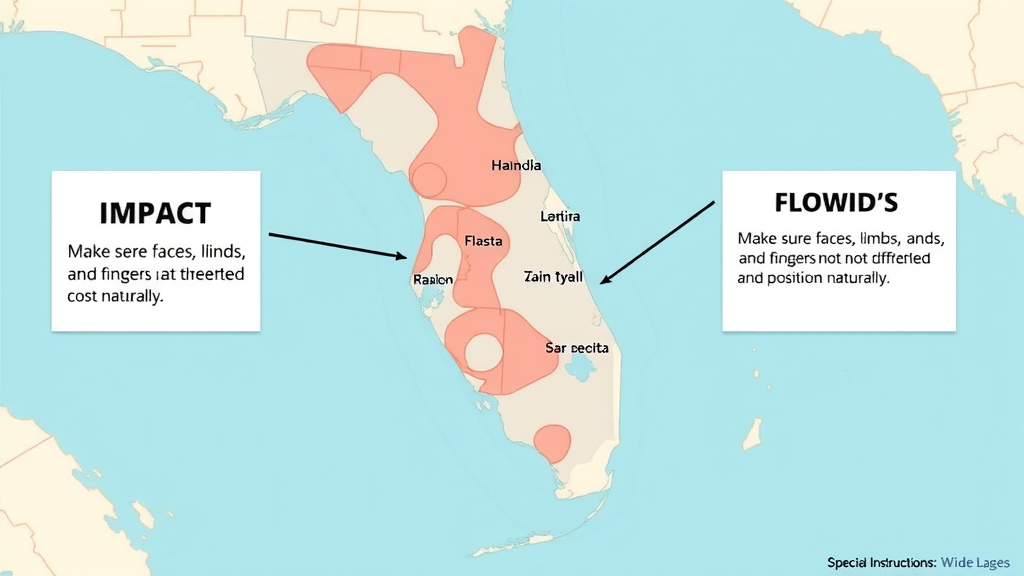

Impact of Flood Zones on Insurance Costs

The flood zone designation can heavily affect your insurance premiums. Properties situated in high-risk zones, such as Zones V and A, generally face the highest premiums due to their increased flood risk. Conversely, lower-risk areas, designated as Zone C or X, offer more affordable insurance solutions.

Homeowners should obtain an accurate flood zone determination, which can be sourced from their local government or FEMA’s flood map service, to secure an accurate and fairly priced flood insurance policy.

Private vs. Government Flood Insurance: Assessing the Costs

With both private and government-issued flood insurance options available, understanding their cost implications is crucial. NFIP policies tend to be more stable and predictable in pricing but may not offer extensive coverage beyond the standard limit. On the other hand, private insurance could offer higher coverage limits and more tailored packages, though possibly at a higher initial cost.

The decision between these options should depend on your specific needs, such as whether you require coverage for contents, additional living expenses, or higher structure coverage. Making a comprehensive comparison of each policy’s terms and costs can lead to more informed choices.

Cost of Homeowners Insurance and Its Relevance to Flood Insurance

Interplay Between Homeowners Insurance and Flood Insurance

Contrary to common misconception, standard

home insurance

policies do not cover physical damage from flooding. Thus, acquiring a separate flood insurance policy is crucial for full coverage against potential flood damage.

Having both homeowners and flood insurance provides a comprehensive safeguard against various risks, ensuring peace of mind. While homeowner’s policies generally cover structural damages from events like fire or theft, a flood-specific plan can mitigate significant financial loss from water-related incidents.

Estimating Home Insurance for a $500,000 House in Florida

Specific estimates for home insurance costs on a $500,000 house in Florida can fluctuate significantly. Homeowners can expect to pay between $2,000 to $3,000 annually, contingent upon factors such as home location, builder quality, and selected coverage limits. These factors, combined with personal risk tolerance and previous claims history, can influence the overall cost and premiums.

Conduct an annual review of your home insurance policy and associated flood insurance to ensure continued adequacy and cost-efficiency, making needed adjustments based on any residential or market changes.

Evaluating Insurance Companies for Competitive Rates

Top Insurance Companies Offering Flood Insurance in Fort Lauderdale

Several insurance companies provide flood insurance

in Fort Lauderdale

, each with their unique benefits and coverage options. Notable names include Allstate, State Farm, and USAA, all offering comprehensive plans tailored to high flood risk areas. Moreover, newer entrants might offer competitive rates and coverage enhancements.

Research and comparison between providers are critical. Look at customer reviews, claims process efficiency, and premium rate trends to decide the best fit based on your budget and coverage preferences.

Criteria for Choosing the Right Insurance Company

When selecting an insurance provider, consider factors such as their financial stability, customer service ratings, and geographic coverage area solutions. It’s also important to check the company’s flexibility in altering policy details, such as coverage limits or deductibles, to adapt to your changing needs over time.

Choosing a reputable company alleviates concern regarding financial claims settlement post-disaster, translating to reliability in times of pressing need.

Analyzing Insurance Cos for Cost-Effectiveness

The insurance market is competitive; hence evaluating each company’s offerings in terms of long-term cost-effectiveness is crucial. Seek insurers that provide discounts for bundled policies or risk mitigation tactics which can result in substantial savings.

Engaging seasoned insurance agents for personalized advice can facilitate better decision-making and yield a more affordable insurance landscape.

People Also Ask: Addressing Common Queries

How much should I expect to pay for flood insurance in Florida?

The cost of flood insurance in Florida varies based on factors such as location and flood zone designation, with average costs typically ranging from $500 to $1,500 annually. Older homes or those in high-risk flood zones may incur higher premiums.

How much is homeowners insurance on a $500,000 house in Florida?

For a $500,000 house in Florida, homeowners might anticipate paying between $2,000 to $3,000 per year in insurance costs, influenced by the location, home features, and specific coverage and deductible choices.

Do you need flood insurance in Fort Lauderdale?

Given Fort Lauderdale’s high flood risk, flood insurance is highly recommended even if it’s not a legislative requirement. It provides financial coverage against flood-related damages that are otherwise not included under standard homeowner’s insurance policies.

What is a good price for flood insurance?

A competitive flood insurance plan is reasonably priced between $500 and $800 annually for low to moderate-risk properties. Factors such as specific coverage limits, deductible levels, and individual home qualities can make this estimation vary greatly.

What You’ll Learn About Fort Lauderdale Flood Insurance Costs

- Key Factors Determining Costs

- Impact of Flood Zones

- Differences Between Private and Government Options

Table: Comprehensive Comparison of Flood Insurance Costs

| Type of Insurance | Cost Range | Key Factors |

|---|---|---|

| National Flood Insurance Program | $500 – $1,000 | Flood zone, home elevation |

| Private Insurance | $600 – $1,500 | Custom coverage limits, additional features |

Quote: Expert Insights on Flood Insurance Costs

“Investing in adequate flood insurance not only protects your property but offers peace of mind in ever-changing climate conditions.”

Key Takeaways from Fort Lauderdale Flood Insurance Analysis

- Understanding Cost Structures

- Selecting the Right Coverage Limit

- Evaluating the Best Insurance Providers

Frequently Asked Questions

Why is flood insurance so expensive in Florida?

The high expense of flood insurance in Florida is primarily driven by frequent severe weather events, high flood risks in coastal areas, and the need for comprehensive flood zone coverage. These factors result in elevated insurance premiums.

Can I benefit from private flood insurance in Florida?

Yes, private flood insurance can provide personalized and extended coverage options that may suit specific property needs better than government options. They often offer higher coverage limits and additional benefits.

Are flood zones a major cost determinant for insurance?

Flood zones are indeed major determinants of insurance costs. Properties in higher-risk zones face significantly elevated premiums due to the increased likelihood of flood events, whereas those in lower-risk areas benefit from reduced premiums.

Conclusion: Navigating Your Flood Insurance Journey

Summarizing Key Points on Flood Insurance Costs

Understanding the cost components, comparing coverage options, and evaluating insurers are integral steps towards finding an affordable flood insurance policy that offers optimal protection.

Exploring Cost-Saving Tips

Implementing improvements like home elevation or flood-proofing methods can significantly reduce insurance premiums. Exploring discounts or bundling policies can also lower costs.

Steps to Secure the Best Insurance Rates

Comparing quotes from multiple insurers, maintaining a low-risk property status, and leveraging agent expertise are vital practices that lead to securing the most favorable flood insurance rates.

Engage with Us for Personalized Insurance Consultation

Contact us for personalized assistance in finding the best insurance solutions customized to your property needs. Our insurance specialists are poised to guide you through this intricate landscape with professional advice and market insights.

For more insights on maintaining your property in Florida, check out our

Florida Pool Maintenance Tips

to ensure your home remains in top condition, even during the hottest months.